This question was submitted by HSA Edge reader Richard. Feel free to send in your question today to evan@hsaedge.com.

My tax adviser informed me I can set up an HSA for 2017 if I do so quickly before the tax filing deadline in April. However, I don’t have a health savings account yet so need to open one. They also told me I can reimburse myself for the eligible out of pocket healthcare expenses that I had in 2017, from my 2017 contributions. However, the HSA custodian tells me I am not allowed to do so. What are the facts?

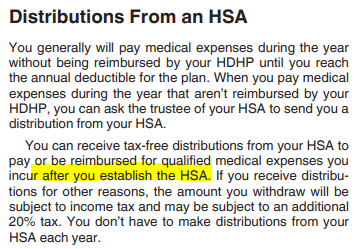

Your tax adviser offered good advice about opening the HSA and using prior year contributions to fund 2017. Even though we are in the new year, as long as you make the contributions by the tax deadline, you can apply them to the prior year. That said, the credit union is correct that HSA funds can only be used for expenses occurring after the HSA is established. This means that you cannot use the prior year contributions in you newly created HSA to reimburse prior year medical costs. This is called out in IRS Form 969:

While you can make contributions for 2017, no medical expenses in 2017 will be considered qualified medical expenses. Even though you lose the ability to pay for those medical expenses with HSA funds, you at least make the contribution, gain the tax deduction, and can pay for future medical expenses with your HSA funds. This is on top of whatever you do in the current year, so assuming you have the funds to contribute, this is the best remaining option.

You cannot reimburse medical expenses that occur before the HSA is established

Note that if you had opened the HSA during the year, you could have used the prior year contributions to pay for qualified medical expenses. Since your HSA was opened after the medical expenses occurred, you cannot use the HSA (ever) to pay for them.

The takeaway is that it is important to open your Health Savings Account if you plan on contributing to it. Delaying this runs the risk that medical expenses will not be qualified medical expenses.

Note: to track valid prior year expenses that you plan to reimburse, consider my service TrackHSA.com for your Health Savings Account record keeping. You can store purchases, upload receipts, and record reimbursements securely online, no matter how far in the future you choose to reimburse them.