The inflation forecasters at the IRS have done it again and released the 2018 Health Savings Account definitions and contributions limits. Surprisingly, this is a pretty good year for HSA savers in terms of increases to contribution limits, but HDHP definitions have tightened a little which might exclude some health insurance plans. You can see the full document released by the IRS here as IRS Rev. Proc. 2017-37 (PDF).

For 2018 the IRS has increased the amount you can contribute to HSA’s with both Self-Only and Family coverage. However, they have also increased what qualifies as an HDHP by raising the Minimum Deductible.

2018 HSA Contribution Limits

If you have an HDHP and have opened a Health Savings Account, below are the contribution limits for self-only and family coverage for 2018.

| 2015 | 2016 | 2017 | 2018 | |

| Self-Only HSA Contribution Limit | $3,350 | $3,350 | $3,400 | $3,450 |

| Family HSA Contribution Limit | $6,650 | $6,750 | $6,750 | $6,900* |

| 55+ Additional Contribution Limit | +$1,000 | +$1,000 | +$1,000 | +$1,000 |

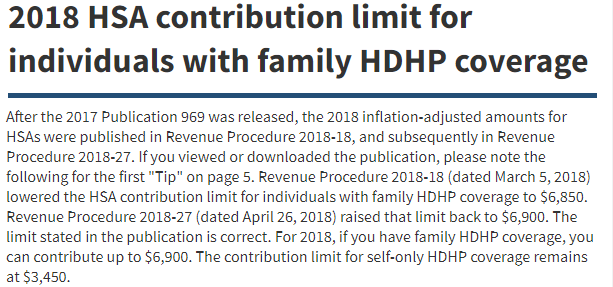

*Note: the IRS reduced the 2018 Family Contribution limit from $6,900 to $6,850 on 3/5/18. They then increased it back to $6,900 on April 26th, 2018. What a time to be alive!

As you can see, self-only HSA’s have the contribution limit increased by $50 for 2018. In addition, the family HSA contribution limit has increased by $150 $100 $150 over 2017, which may be a record increase. These are important as this governs the deduction your HSA allows, allowing you to save more in taxes. It is interesting that both self-only and family contribution limits increased in 2018. For the past few years, only one would increase while the other stayed constant, and the pattern would reverse the following year. But perhaps something has changed as both receive an increase in 2018. Not surprisingly, the age 55+ catch up contribution remains flat at an additional $1,000.

2018 HDHP Limits

Below are the 2018 HDHP deductible limits as well as out of pocket maximums that determine whether or not your plan is an High Deductible Health Plan, and thus, whether or not you can contribute to a Health Savings Account.

| 2015 | 2016 | 2017 | 2018 | |

| Self-Only Min Deductible | $1,300 | $1,300 | $1,300 | $1,350 |

| Self-Only OOP Max | $6,450 | $6,550 | $6,550 | $6,650 |

| Family Min Deductible | $2,600 | $2,600 | $2,600 | $2,700 |

| Family OOP max | $12,900 | $13,100 | $13,100 | $13,300 |

2018 sees both the self-only and family minimum deductible tick up by $50 and $100, respectively. This is a negative for HSA’s as the higher required deductible reduces the number of insurance plans that qualify for HSA’s, with some Obamacare plans falling just below this threshold. Offsetting this somewhat is a family out of pocket maximum increases $200 to $13,300, which is positive as this higher maximum includes more health insurance plans as HDHP’s. However, the minimum deductible is weighted more heavily and thus a net negative as more plans are weeded out due to a deductible on the margin than hitting up against the out of pocket maximum.

————————————

Note: If you are in the market to buy or sell agricultural or heavy duty equipment (tractors, combines, excavators, etc.) please consider EquipmentRadar.com.