This question was submitted by HSAedge reader Beth. Feel free to submit your question today to evan@hsaedge.com.

I have an employer that is implementing an HSA eligible plan on 4/1/2017. Of course, everyone wants to invoke the “last month rule” but we keep telling them that is not a best practice due to the possible tax implications should they switch plans etc. Can you give some examples of “problems” with someone enrolling 4/1/2017 invoking the last month rule and not remaining covered during the testing period?

That is certainly a good question and applies to many people who begin HSA coverage mid year. As I see it, they have two options in front of them – reduce their contribution pro rata for the months covered, or contribute the full year amount by using the Last Month Rule. The former is safe with no risk of paying taxes and penalties in the following year, while the latter allows you to contribute more in the current year.

Contribute Only for Months Covered to Lower Risk

Let’s be clear on the situation facing your team. With coverage beginning on April 1st 2017, they will have 9 months of HSA eligible coverage for 2017. Stated differently, they are covered by a HSA eligible insurance for 75% (9/12) of 2017. Since they only have partial year coverage, the amount they can safely contribute to their HSA that year is reduced pro rata. In this case, they can contribute 75% of the contribution limit based on their coverage type and age, no strings attached. For 2017, these amounts are:

- Self only: $3,400 x 0.75 = $2,550

- Family: $6,750 x 0.75 = $5,062.50

- if 55+: $1,000 x 0.75 = $750 in addition to above

So they can contribute those amounts, free and clear, and be finished. Making contributions for the months you had HSA eligible coverage means you never have to worry about taxes or penalties relating to the Last Month Rule.

Contribute More Using Last Month Rule

However, they may be aware that there is a provision called the Last Month Rule that states that if they have HSA eligible insurance on December 1st of a year, that they can contribute the full year contribution limit. Assuming they maintain HSA eligible coverage until December, this election allows them to contribute 100% of the $3,400 or $6,750, instead of just 75%. However, what they may not know is there is a catch. By taking advantage of the Last Month Rule, they are bound by the terms of the Testing Period. This basically states that they need to maintain HSA coverage for the following 12 months, or the amount they contributed above their calculated (75%) amount will be taxed and penalized.

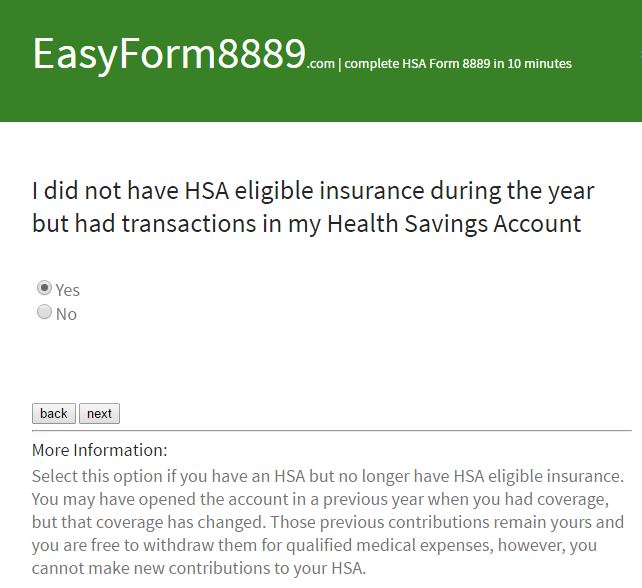

People fail the Testing Period more often than you think, and it causes tax problems when they go to file Form 8889. It is difficult to predict over a year in advance what your insurance situation will be. Some events are not foreseeable. Other people don’t even know what the Testing Period is! For example, here are some common reasons people’s insurance changes and they fail the Testing Period:

- Change jobs and get new insurance

- Lose job and lose insurance

- Change to a non HSA-eligible plan

- Go onto spouse’s insurance

- Change to state health insurance (Obamacare)

- Go onto Medicare

- Start taking Social Security

Any of the above will likely cause you to fail the Testing Period and owe taxes and penalties.

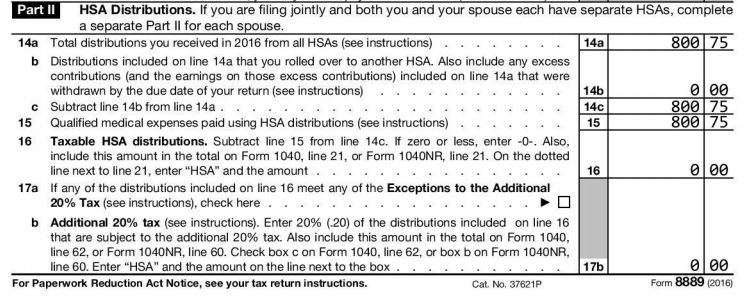

Calculating Taxes and Penalties for Failing the Last Month Rule

If you fail the Testing Period, you will have to go back and do a bunch of work for Form 8889. The IRS will have you compare the amount you contributed ($3,400 or $6,750) to the amount you could have contributed without the Last Month Rule ($2,550 or $5,062.50). The difference will be added to your taxable income for the current year and assessed a 10% penalty.

Here are the tax and penalty calculations for our previous examples. Assume you had 9 months of coverage and used the Last Month Rule to contribute the full 2017 contribution limit:

- Self only: $3,400 – $2,550 = $850 added to income (taxed); $85 penalty

- Family: $6,750 – $5,062.50 = $1,687.50 added to income (taxed), $168.75 penalty

- if 55+: $1,000 – $750 = $250 added to income (taxed); $25 penalty in addition to above

As you can see, failing the Testing Period means writing Uncle Sam a check for taxes and penalties. For some people, this is a bad bet because they change insurance frequently, or the taxes / penalties / headache aren’t worth the additional risk. They contribute a little less this year but no big deal. For others, this is a good risk because they have stable insurance. It allows them to contribute more to their HSA and reduce current year taxes. There is no “right” answer and it is up to the individual HSA holder to decide.