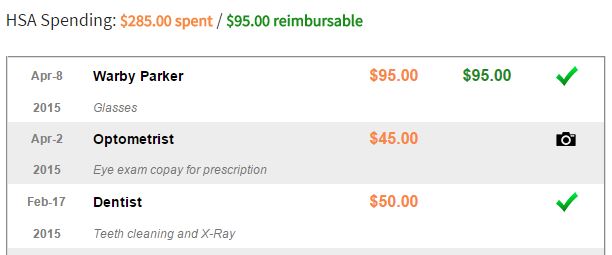

Form 1099-SA Overview

Form 1099-SA is a form that your HSA custodian is required to file and send you each year you make distributions from your Health Savings Account. Its job is to quantify the monies that have left your HSA during the year, otherwise known as HSA distributions. There are many reasons that HSA distributions occur, including paying for qualified medical expenses, reimbursing yourself for previously paid qualified medical expenses, and cashing out your HSA. Your HSA custodian (bank) provides you this information in an official format so that the government knows the “official” figure when you go to file HSA tax Form 8889 for a given tax year. Form 1099-SA is a control to see money leaving the account, and Form 8889 verifies is was spent correctly.

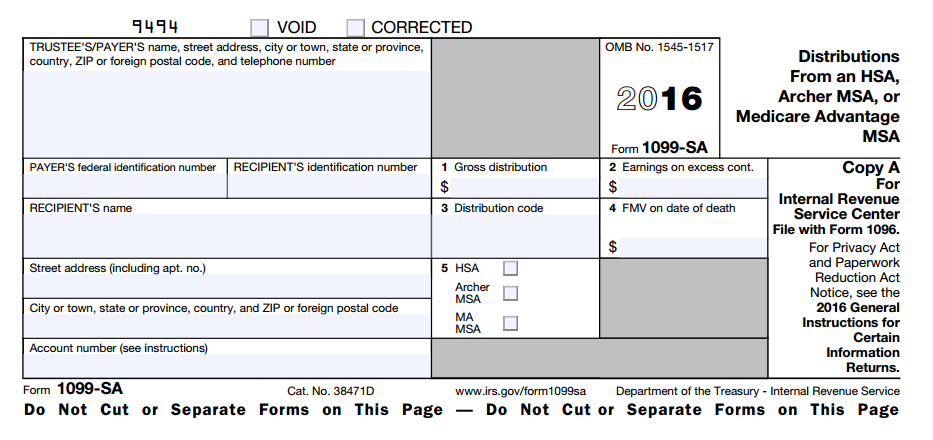

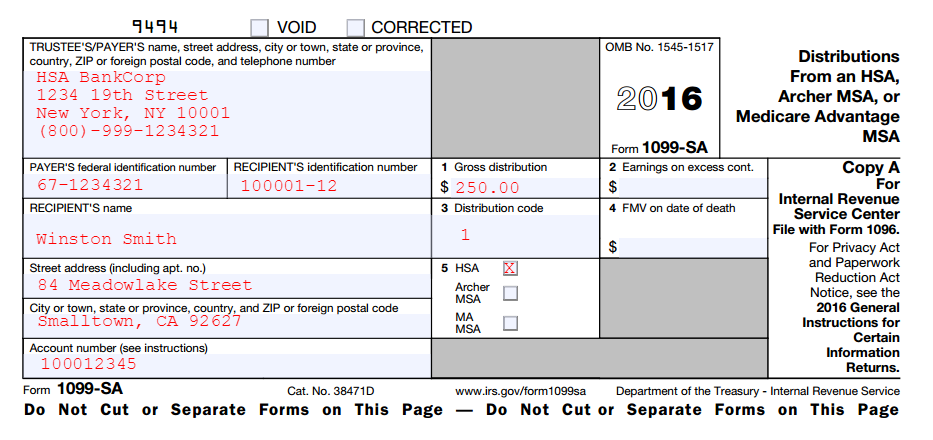

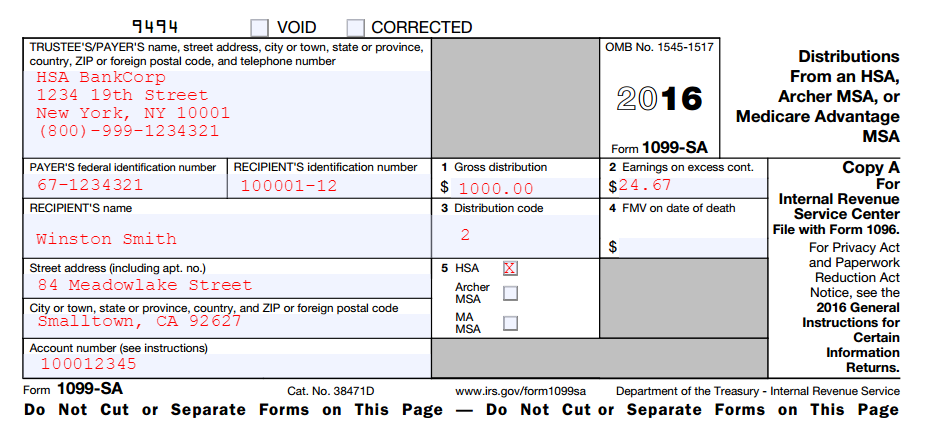

An example of HSA Form 1099-SA for 2016

Form 1099-SA Instructions

There are basically two parts of Form 1099-SA that you will see. The left hand side contains trustee (bank) and account holder information, while the right hand side includes multiple pieces of information about the distribution, its classification, amount, and tax treatment. This information is contained in Form 1099-SA boxes that we will cover here.

- Box 1 Gross Distributions

This box represents the total amount of the distribution, but does not include earnings (see Box 2). Basically the total amount that came out of the HSA for a given distribution code (see Box 3). This section does not include withdrawal of excess employer contributions (and earnings) or excess MA MSA contributions, if this applies. - Box 2 Earnings on Excess Contributions

This box only applies if you have Excess Contributions to your HSA, and it shows the total earnings on excess contributions that were returned (distributed) before the tax return due date. It calls out these “special” (read: taxable) earnings that only occurred because excess contributions were sitting in your HSA. - Box 3 Distribution Codes

Form 1099-SA has a section in Box 3 that labels the type of distribution being reported. See the next section called “Box 3 Distribution Codes” to understand the codes found here. - Box 4 FMV on Date of Death

If the account holder has died, the fair market value of the account is entered on the date of death. - Box 5 Checkbox

This is a simple checkbox to indicate whether the distribution is from an HSA, Archer MSA, or MA MSA.

Box 3 Distribution Codes

Form 1099-SA has a coding scheme on Box 3 that describes the type of distribution being recorded on the form. There are six types of distribution codes that are described below. Note that you may receive multiple Form 1099-SA’s with different distribution codes. This is so they can clearly delineate different tax treatment of distributions and handle them separately.

- Normal Distributions – normal distributions for the account holder (e.g. reimbursing previously paid expenses) or direct payments to a medical service provider. Used if no other code applies – basically if you take money out and don’t flag it as one of the other codes, they will code it this way.

- Excess Contributions – if you are removing Excess Contributions from your HSA, it will be coded as a 2. For example, if your contribution limit for 2016 is $3,400 and you contribute $4,000, you can remove $600 before you file your tax return free of penalty. This $600 will be flagged as a 2 here.

- Disability – this code flags distributions after the account holder became disabled. This involves alerting your HSA custodian that you have become disabled, and ties into line 17a on Form 8889.

- Death Distribution (other than code 6) – this is used for payments to a decedent’s estate in the year of death. It also codes payments to an estate after the year of death. See the instructions for more details.

- Prohibited Transaction – codes transactions per IRS sections 220(e)(2) and 223(e)(2). Basically transactions should not have occurred or are in error.

- Death Distribution after year of death to nonspouse beneficiary – this is for payments to a nonspouse beneficiary, other than an estate, after the year of death. There are special HSA considerations for the year after an account holder dies. This code is basically a full taxable flag to remove the funds as non HSA (going forward).

HSA Form 1099-SA – Examples

The below images show what a completed Form 1099-SA might look like from your HSA custodian. You can expect to receive this in the first few months of the new year, before your taxes are due. Some HSA banks send the form electronically so keep an eye on your email or check your bank documents within your account.

Here is an example of the most common distribution code 1 – a normal distribution used to purchase a qualified medical expense:

And here is an example of what an Excess Contribution might look like on Form 1099-SA:

HSA Transfers avoided on Form 1099-SA

You will not see trustee to trustee transfers for your HSA. This also includes transfers from an MSA to an HSA, and vice versa. A trustee to trustee transfer occurs when your bank transfers HSA funds directly to another bank which also holds an HSA for you. You do not receive a check, and these amounts are not included as contributions or rollovers. Basically you are just transferring money between HSA accounts so nothing to report. See the difference between HSA Rollovers and Qualified HSA Funding Distributions.

Mistaken Distributions on Form 1099-SA

It may occur that you accidentally or mistakenly distribute from your HSA when you shouldn’t have. Most often money is transferred out of your HSA for a reasonable reason that turns out to be in error. Luckily, the IRS allows you to pay back an incorrect HSA distribution without penalty. You want to correct the situation that year as otherwise, you will incur penalties and taxes on the mistaken distribution. Per the IRS Instructions for Form 1099-SA:

If amounts were distributed during the year from an HSA because of a mistake of fact due to reasonable cause, the account beneficiary may repay the mistaken distribution no later than April 15 following the first year the account beneficiary knew or should have known the distribution was a mistake.

For example, if $1000 is mistakenly distributed from your HSA, and you had $0 spending on HSA’s this year, Line 16 of Form 8889 will show a positive $1000 which will be taxed and penalized. This is because without a qualified medical expense to offset it, the distribution is treated as a non qualified distribution. Instead, you can inform your HSA custodian before April 15th of the following year, and pay the distribution back. This might occur if you thought an expense was qualified but is not. In this case the withdrawal is not taxed or penalized, and paying it back is not treated as a contribution (or excess contribution) on Form 5498-SA.

Death of Account Beneficiary

There is quite a few different scenarios that can occur at the death of an HSA account beneficiary. Basically, if a spouse inherits the HSA, it continues being an HSA in their name. Otherwise, the HSA is liquidated and ceases to be an HSA. Much of this is outside the scope of this article but please the IRS Instructions (pdf) for Form 1099-SA for more information.

————————————

Note: if you are struggling with HSA taxes, please consider using my service EasyForm8889.com to complete Form 8889. It is fast and painless, no matter how complicated your HSA situation.