Overview

Regardless of your political leanings, Donald Trump’s election was an upheaval which will have stark implications for health care in this country. We know he has campaigned to repeal and replace Obamacare, but exactly what he attempts to replace it with is still an open question. Based on the limited evidence that we have, Health Savings Accounts (HSA’s) will make up a core tenant of Trump’s health insurance policy. In this article we will dive into this proposal and what it may mean for the future of Health Savings Accounts.

How Obamacare nearly killed HSA’s

First a quick story. We know that the Affordable Care Act (ACA or Obamacare) is broken: not only for the insurers who lost billions of dollars in ACA markets last year, but the subscribers whose premiums are unaffordable and options severely limited. However, 2017 was to be a critical year for Obamacare regarding Health Savings Accounts, as a process designed to systematically phase out Health Savings Accounts (HSA’s) from ACA coverage began. They engineered this by making all ACA plans ineligible for HSA’s – by exceeding the limits on the upper bound. This was based on how the IRS defined HDHP’s for 2017:

For calendar year 2017, a “high deductible health plan” is defined under § 223(c)(2)(A) as a health plan with an annual deductible that is not less than $1,300 for self-only coverage or $2,600 for family coverage, and the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $6,550 for self-only coverage or $13,100 for family coverage.

So what did the brilliant engineers of Obamacare come up with? Roy J Rantham explains how they “stacked the deck” in this excellent article (from April 2016). His analysis:

- Bronze standardized plans will be required to have a deductible of $6,650. This amount is $100 above the projected maximum deductible of $6,550 for HSA-qualified plans for 2017.

- Gold standardized plans will be required to have a deductible of $1,250. This amount is $50 below the projected minimum deductible for HSA-qualified plans for 2017.

- Bronze and Silver standardized plans will be required to have out-of-pocket limits of $7,150, well above the projected out-of-pocket limit of $6,550 for HSA-qualified plans for 2017.

In summary, Obama’s team made their ACA plans so bad that they fell outside the upper bound for what constitutes an HSA. A maximum deductible of $6,550/year is incredibly expensive, and every single ACA plan in 2017 had a higher deductible. This pattern would likely continue in future years, with HSA’s being priced out for subscribers to government run health insurance. They would no longer be an option for the ACA population, and while HSA’s would still be available for non-ACA plans, they would remain at risk in a government not favored to their existence.

Trumps Proposed Health Care Policy

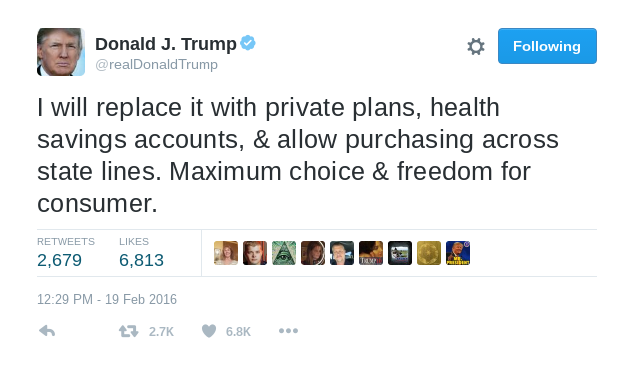

While specifics are not yet available for Donald Trump’s numerous policy recommendations, we can gauge the general ethos based on his history and current documentation on his website. Trump took to his favorite medium Twitter back in February 2016 to (concisely) explain how to fix Obamacare, which made mention of Health Savings Accounts:

So a general repudiation of the signature law enacted by President Obama, with more free market choices for the consumer. Trump recently provided some specifics on his website, and the page is worth a read. There are good ideas there about making health insurance more competitive across state lines, allowing consumers to deduct health insurance premiums (like corporations), and eliminating the individual mandate. Notably for this website, he even includes a section on HSA’s saying:

Allow individuals to use Health Savings Accounts (HSAs). Contributions into HSAs should be tax-free and should be allowed to accumulate. These accounts would become part of the estate of the individual and could be passed on to heirs without fear of any death penalty. These plans should be particularly attractive to young people who are healthy and can afford high-deductible insurance plans. These funds can be used by any member of a family without penalty. The flexibility and security provided by HSAs will be of great benefit to all who participate.

Clearly Trump is in favor of Health Savings Accounts. However, like much of his policy at this time, not much exists in terms of details. That leaves us to speculate on how Trump may implement a broader HSA approach in lieu of Obamacare.

Possible Changes Trump Will Make to HSA’s

Since we don’t know exactly how Trump will further the use of HSA’s, we have come up with some predictions (suggestions?) of how he may utilize these plans to provide more Americans with better options for their health insurance. The goal of each of these would be to offer more consumers more choices to help ease the pain of rising health insurance costs.

1) Increase HSA contribution limits

One quick win would be to increase the amounts individuals can contribute to HSA’s. In 2017, the contribution limit for self-only/family coverage is $3,400/$6,750, respectively. Trump could increase those amounts to give more choices to those who can fully fund their HSA, including workers in the prime of their working years and those who receive employer contributions. Doing so would better allow them financially manage health care costs (and retirement) in the future.

2) Widen HDHP Definitions

Working in conjunction with the IRS, Trump could widen the net of to whom HSA plans apply by changing how High Deductible Health Plans are defined. By allowing more plans to be considered HDHP’s, more consumers would benefit from the option available from a Health Savings Account. For example, for self-only coverage in 2017, the minimal annual deductible could be reduced from $1,300 to $1,000 or even $500, lowering the lower bound of what constitutes an HDHP. In turn, Trump could raise the maximum out-of-pocket limit from $6,650 to $7,000 or even unlimited, which would include more plans, including all of those ACA plans that were left behind this year.

3) Increase eligibility for Health Savings Accounts

A stronger form of point 2 above, Trump could in theory make Health Savings Accounts allowable for anyone in the country, regardless of insurance coverage. Any why not? Why does someone have to have a certain type of health insurance to receive this government benefit? Is that truly “fair”? In an age where everyone’s health insurance costs are increasing, why would we limit access to a savings vehicle to help consumers manage costs? Trump could work with Congress to change HSA’s to a similar structure as IRA’s, which are allowable for anyone. Some would argue that the “rich” would receive an added $3,400 / $6,750 tax break, which is true (editor: as if this were a bad thing). However, the other side of this is anyone (poor, middle class, rich) who saw benefit could contribute to an HSA and save money on their medical expenses. In this situation, Trump would give everyone the opportunity to benefit from HSA’s equally.

4) Expand definition of qualified medical expenses

Trump has already hinted at this in the second point of his policy, which would make health insurance premiums tax deductible for individuals. In essence this makes them a qualified medical expense, but without the need for an HSA (since it would apply to everyone). The same could be done for a wider list (see page 16 of Publication 502 (PDF)) of common medical expenses that are commonly consumed, such as drugstore medications. Others include weight loss programs, cosmetic dentistry or procedures, nutritional supplements, and personal use items.

————————————

Note: if you have an HSA, please consider trying my service TrackHSA.com for free for your Health Savings Account record keeping. You can store purchases, receipts, and reimbursements securely online.