Need help keeping track of your HSA throughout the year? Sign up for the HSA Edge newsletter for infrequent but important updates.

After saving diligently, using either individual or employer contributions, you may want to take your money out of your Health Savings Account and use it for something different. Before you go to the ATM or HSA website and withdraw all of your HSA funds, take heed: there may be tax consequences to improperly withdrawing money. Let’s discuss the implications and options.

Part of the advantage of an HSA is that the money is triple tax advantaged – you are able to save significantly on taxes by contributing to the HSA. The catch is, this money is required to be used for qualified medical expenses. As such, the government does not look fondly at taking a tax advantage and then not playing by the rules.

Nevertheless, let’s discuss 4 options for removing money from an HSA account:

1) Non Qualified Withdrawal (Penalty Tax)

This is the hard way, just rip the money out and pay the price. From the IRS HSA page:

You can receive tax-free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA. If you receive distributions for other reasons, the amount you withdraw will be subject to income tax and may be subject to an additional 20% tax.

Yes, that 20% tax sure bites, as it was your money to begin with but it is stuck in a “special” government account. That said, this is always an option. When you file your IRS Form 8899, you will have to call out this amount on Line 16 as a taxable distribution. This amount will be added as income on Form 1040 (i.e. you will then pay tax on it), plus Line 17b will assess a 20% penalty that flows over to Form 1040. An expensive option, but at least you can get the funds out of the HSA.

2) Use for Qualified Medical Expenses

This is the right way to remove funds from an HSA account, paying for (or reimbursing) qualified medical expenses. Assume you have a doctor appointment that you pay for out of pocket using a credit card, debit card, or cash. Since this is a qualified medical expense, you are immediately entitled to reimburse yourself for that expense out of your HSA. This is simply a transfer from HSA to other account for the amount of the expense, justified by the receipt. Little by little, you can gradually drain your HSA as you use it to pay for qualified medical expenses. Or, you may want to pull an expense (say, surgery or dental expense) forward so at least you can use those HSA funds. Remember, you can spend HSA funds on other people than just yourself.

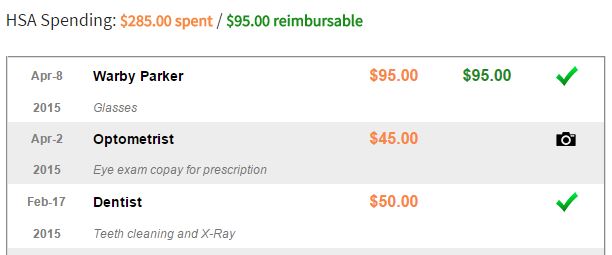

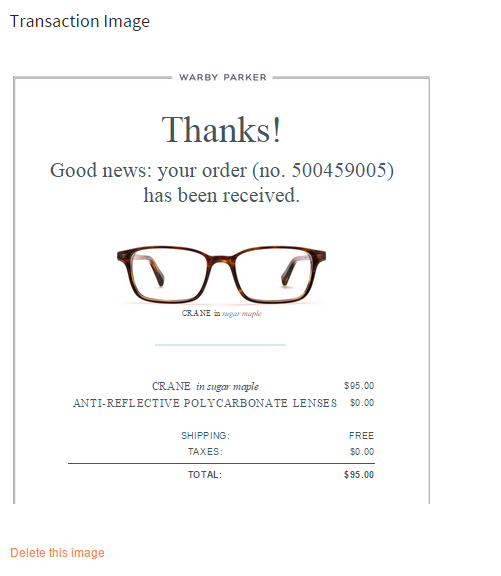

Alternatively, you can preempt this situation by building up a nice stack of pending reimbursements. This would involved paying for medical expenses out of pocket and delaying your reimbursement from the HSA. You are then entitled to that reimbursement at any time. Eventually, these reimbursements can add up and you can withdraw a large sum from your HSA. My service TrackHSA.com is a great way to keep a record of these un-reimbursed transactions.

3) Invest your HSA, offset by separate account withdrawal

We know that you can invest your HSA account in stocks, bonds, ETF’s, etc. to let it grow over time. If you need cash, consider other sources first. Instead of raiding your HSA, consider withdrawing funds from a different investment account with no / less penalty. Then, you can invest your HSA to “replace” your prior withdrawal.

For example, assume that I need $2k for some reason. Instead of withdrawing from my HSA and facing a penalty, I could withdraw this from a more liquid account, such as an investment account. I could then offset this by investing my HSA in the same instruments that I just sold, so my investment position is maintained. This could also work if the other account (such as a 401(k)) has a withdrawal penalty but it is smaller (say, 10%) than that of the HSA (20%).

4) Use the funds for anything once you turn 65

Once you turn 65 years of age, your Health Savings Account is liberated substantially. You are free to spend your HSA funds on whatever you want, not just qualified medical expenses. Note that any distribution for non qualified medical expenses will be taxed (just like ordinary income), but at least you are getting the funds out of your HSA. This is fair as well because you never paid tax on the HSA contribution – since you didn’t use it for medical expenses, they make you pay it now. However, you may have gotten the benefit of tax free investment earnings on that money for many years. Either way, this is superior to option 1 above as you do not owe the 20% penalty, just the tax. And that 20% can be a huge number

Note: if you have an HSA, you need to file IRS tax Form 8889 each year you make contributions or withdrawals. Please consider using my automated service EasyForm8889.com to quickly and easily generate your HSA Form 8889. In 10 minutes, it asks you simple questions that correctly populates Form 8889 no matter your situation and delivers you the completed PDF.