There are often a lot of questions about the differences between HMO’s (Health Maintenance Organizations) and PPO’s (Preferred Provider Organizations) insurance plans. Understanding this difference can help you select the best insurance plan for your situation and family. Moreover, people wonder if an HSA (Health Savings Account) is also an option, and how this relates to the big picture.

First, Understand Your Plan’s Network

An insurer has a unique network of doctors, care centers and hospitals that they partner with. Because they have contracts and partnerships, they work together to provide you care at pre-determined rates. Additionally, since they are aligned with costs, billing, and procedures, the process is much easier for the patient. Basically, they know what to do and how to handle your case. Visiting a member of this partnership is considered in-network care and is significantly cheaper than any other alternative. Basically, you want to receive care in-network if possible.

Out-of-network care are providers outside of this realm and are generally more expensive. These hospitals/providers are not in your insurance company’s “club” and you do not gain the “club’s” advantages by visiting them. Because they do not regularly do business together, their cost structure, billing, and information exchange may be separate or disjointed. More importantly, in-network providers have a quid pro quo type of relationship. Since they work together, they agree to bill each other at reduced rates and generally make things easier all around. This is completely lost when you visit out-of-network providers, and you may be surprised how expensive some procedures can be. As you can imagine, reimbursement rates are lower (if at all) for out-of-network care. This means you end up paying the entire bill for out-of-network care.

Both HMO’s and PPO’s have in-network and out-of-network care. The difference is how much of each is covered by insurance.

HMO (Health Maintenance Organization)

The main tenant of an HMO is that you select a primary care physician (from a list) who manages your health care. Think of this as the family doctor that you see first whenever something happens. When you fall sick, he assesses your symptoms and either prescribes medicine or schedules further tests. Often times, visiting other specialists requires a referral from your physician, so in this regard they act as a gatekeeper. Many people find confidence in developing a relationship with their doctor, which can lead to better care. For others, the process is more indirect and time consuming.

HMO’s have a smaller network than PPO’s. It is more localized with fewer options, which will often be determined by the doctor. Think of it this way: you fall ill, visit your doctor, who points you to the specialist who is in network. Just because the network is smaller does not mean that the coverage is any less excellent; the “club” is just smaller. Moreover, cost of in-network care at HMO’s is the lowest. This is your return for following the rules and visiting your physician. The downside is that out-of-network care is often much more expensive and may not be covered by the HMO.

PPO (Preferred Provider Organization)

The PPO is based on a network of “Preferred Providers” through whom you are allowed to schedule care. While you may have a primary care physician, you do not need referrals or to see them before seeing a specialist. Instead, you can research which specialists are considered preferred in your plan’s network and make an appointment. This list of “Preferred Providers” constitute the in-network portion of care. This network is generally larger than a HMO’s network.

PPO’s also have an advantage in out of network care. Because they are larger, they have more contacts with other networks and can afford you cheaper care should you venture out-of-network. Check your plan for details, but many PPO’s offer coinsurance for out-of-network care, which can help you should you require it. Moreover, monthly premiums are generally lower for PPO plans, while in-network rates may be slightly higher than HMO’s.

| HMO | PPO | |

|---|---|---|

| Primary Care Physician | Yes | No |

| Referral for Specialist? | Yes | No |

| Network size | Smaller, local | Larger, broader |

| Monthly Premiums | Generally higher | Generally lower |

| In-Network | Lowest rates | Low rates | Out-of-Network | May not cover | May reimburse a % |

| Copay | Often | Often |

| HSA eligible | Some | Some |

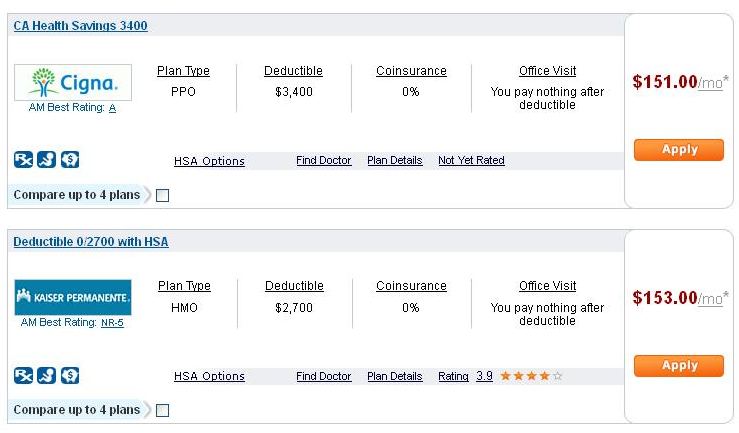

How does an HSA fit in?

People often wonder how an HSA relates to a PPO or HMO. A succinct summary of the difference:

Your health insurance plan is either an HMO or PPO, which may also qualify you to open an HSA

Thus, they are two separate characteristics. Your plan’s network and cost structure is determined by whether it is an HMO or PPO. Your ability to contribute to save money tax free is determined by whether that plan is HSA eligible. You can have a PPO, a PPO with an HSA, an HMO, or an HMO with an HSA. You can’t just have an HSA, because it is an benefit allowed by health insurance plans that are HSA eligible. According to the AHIP’s Center for Policy research, the majority (80-93% across groups) of HSA plans were in PPO products.