In order to take advantage of the many tax benefits of Health Savings Accounts, there is a tax reporting requirement that occurs each year. When you file your taxes via TurboTax, H&R Block, etc., you are required to report HSA information on Form 8889, the IRS tax form for HSA’s. It is a slightly annoying, overly-engineered two page tax form that is required for those with transactions in their HSA during the year. As you will see, there are multiple scenarios that can cause confusion on who needs to file this form. Hopefully we address them all and provide clarity on your situation.

HSA Transactions require Form 8889

You need to file Form 8889 for the year if transactions occurred in the HSA. What are transactions? These include:

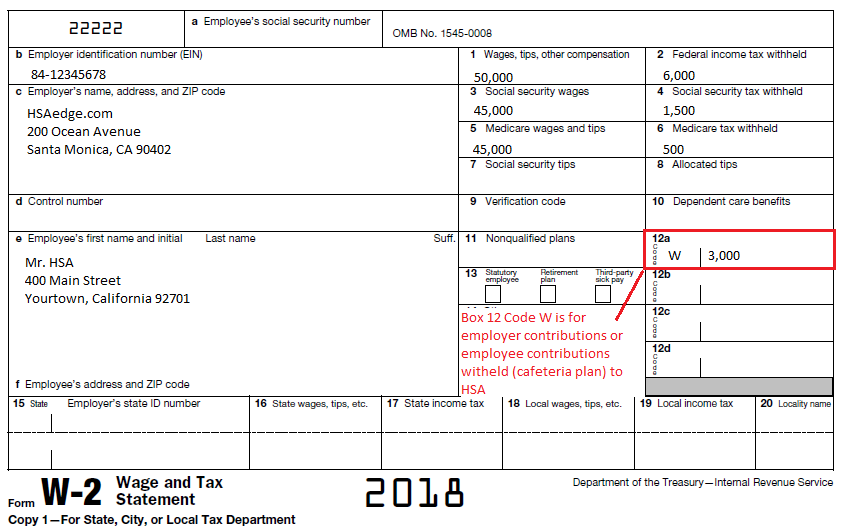

- Contributions made to HSA

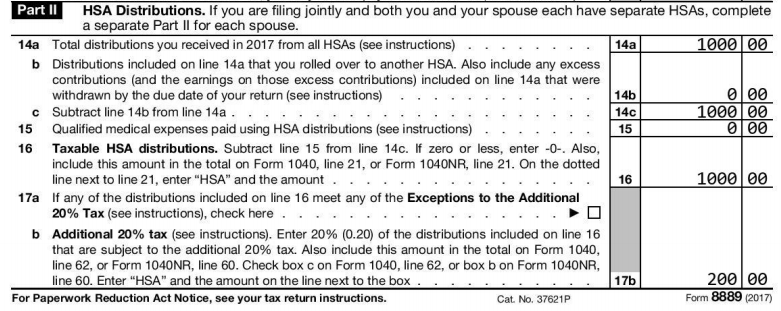

- Distributions from HSA

- Penalties for failing testing period

- You acquired HSA due to death of beneficiary

If any of those apply to your HSA this year, you need to file Form 8889 with your taxes. On the other hand, if your HSA sat idle during the year, you do not need to file Form 8889. A common example of this is you 1) no longer have HSA eligible insurance, so are not contributing to the HSA and 2) you did not make any distributions from the HSA this year. If you make distributions (or contributions) in the future, you would file the form with that tax year.

Preparing Form 8889 for family coverage

To summarize who needs to file Form 8889:

File Form 8889 for each person with a Health Savings Account that had transactions during the year.

Notice the “each person with a Health Savings Account” part. This means each person with a Health Savings Account; you know, like a bank account that exists at a financial institution. If both you and your spouse have a Health Savings Account, and you made contributions or distributions to either during the year, you each need to file separate Form 8889’s.

This is important because Form 8889 reflects the tax benefits (and penalties!) associated with the HSA itself. For a family with 2 HSA’s, the two Form 8889’s will total your combined activity for the year. For example, a $6,900 contribution limit resulted in $3,000 contributed to HSA 1 and $3,900 was contributed to HSA 2, etc. Both of these need to be reported.

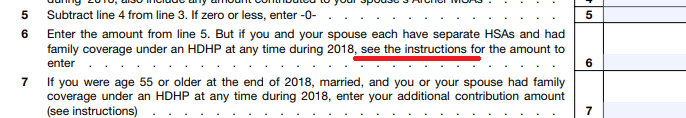

Why do you need to file 2 Form 8889’s in that scenario? It is because of the magic “Line 6” split for married couples with separate HSA’s.

Spouses who have separate HSA’s and family coverage “split” the contribution limit.

This means that with family coverage and 2 HSA’s, each HSA is receiving an allocation of the HSA contribution limit. While you are allowed to make this allocation however you want (save for the 55+ catch up contribution), each HSA receives an allocation. The result is you cannot file one Form 8889 and capture the tax implications, as even “$0” needs to be reported.

[Note: the Line 6 split is especially complicated. If you don’t want to read the 1+ pages of IRS instructions, have EasyForm8889.com take care of it for you.]

Below is a review of common scenarios and how Form 8889 must be filed.

1) What if my spouse and I have family coverage?

If you were on family coverage during the year, you need to file Form 8889 for each HSA that existed and had transactions. If only you have an HSA, and the full contribution limit went into it, you only need to file one Form 8889 reporting those transactions. On the other hand, if both you and your spouse have an HSA, and you split the contribution limit per Line 6, you both need to file a Form 8889.

2) What if my spouse has their own HSA?

If your spouse has their own HSA, you will need to file a Form 8889 for it. Again, this assumes transactions occurred in the HSA during the year. Alternatively, if the HSA just kind of sat there, and no contributions nor distributions occurred, you do not need to file Form 8889 for it.

3) What if my adult child has their own HSA?

A nice loophole of HSA’s is that adult children on family coverage can open their own HSA. This allows them (or you, or others) to fund a substantial amount each year. The minor downside here is they will need to file a Form 8889 for each year transactions occur. So this is an additional form to file, potentially a 3rd (or 4th!) if both spouses have an HSA.

4) What if my spouse is 55 or older?

One specific rule about the 55+ catch up contribution of $1,000 is that it must follow the person who is over 55. This means that if you are over 55, and you want to take advantage of the 55+ contribution, the $1,000 needs to go into your HSA. You cannot place your $1,000 into your partner’s HSA.

For example: say the husband is 56 years old on family coverage but the insurance and HSA are in the wife’s name. His $1,000 cannot go into her HSA. Instead, the husband needs to open his own HSA and contribute the $1,000 (and any Line 6 “split” of the family contribution limit) there.

5) What if my spouse and I are both 55 or older?

As you might guess from the previous scenario, each spouse who is over 55 needs their own HSA if they are going to take advantage of the 55+ contribution. For couples on family coverage who are both over 55, this means you need 2 HSA’s to fully maximize your contribution. This maximum would equal the family contribution limit plus $1k for spouse and $1k for other spouse. Opening the HSA should not cost you anything. It is a little annoying to file the additional Form 8889, but this is the only way to maximize your 55+ contribution for the year.

Note: If you want help preparing any of your HSA tax forms this year, please consider my service EasyForm8889.com. It asks you simple questions and fills out Form 8889 correctly for you in about 10 minutes.