Come tax time when you need to file Form 8889, you may be wondering how to find your contributions to your HSA. We know that you should be receiving Form 5498-SA from your HSA custodian that outlines the total contributions that went into your HSA during the year. However, this form is a lump sum total: it does not break out employer (no tax impact) vs. employee (tax deductible contributions); it just shows how much went into the account that year. Also remember that form 5498-SA may be missing prior year contributions made in the current year.

So how can you figure out your employer contributions that were made? How can you use this information to complete Line 3 and Line 9 of Form 8889?

A word about Cafeteria Plans

For one, let’s clarify that cafeteria plan contributions are counted as employer contributions. Cafeteria plans are when your employer withholds your contributions which they send to the HSA custodian for you. So these are employee contributions but your employer is doing the work for you. The benefit of cafeteria plans is that they are already pre-tax; not just income tax, but medicare / social security / other tax. So you save the taxes up front and get them deposited automatically into

You will see that for both the W2 and Form 8889, cafeteria plan contributions function just like employer contributions, not employee contributions.

Employer vs. Employee Contributions on W2

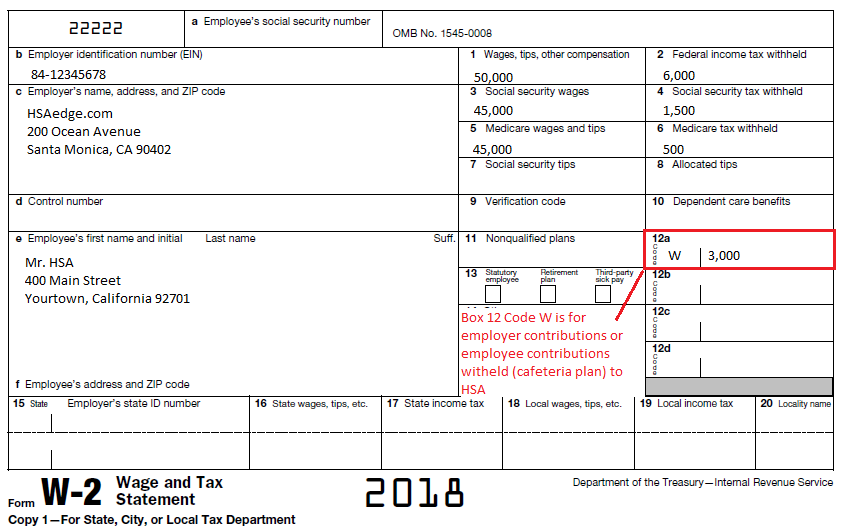

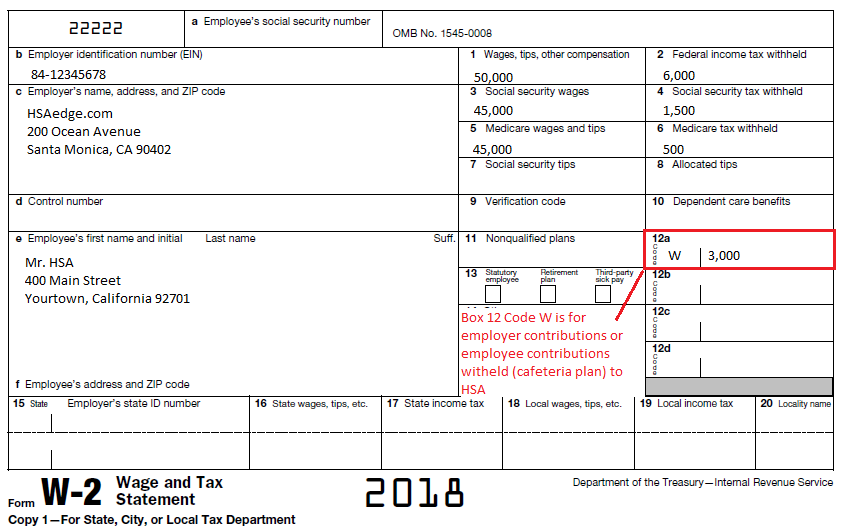

When you receive your W2 at year end, you will have a Box 12 marked with “W” and your employer contributions for the year. As mentioned, this amount will contain:

- Amounts your employer contributed to your HSA

- Amounts you contributed to your HSA through your employer via a cafeteria plan

Here is what Form W2 looks like for 2018 with HSA contriibutions:

So this box indicates any employer contributions for the fiscal year. Note that this box will not contain any prior year contributions – these will need to be added to the amount. If your employer pays a bonus or end of year contribution into your HSA that occurs in the following year, be sure to add that in.

Around the same time you will receive Form 5498-SA from your custodian. It will detail the total contributions made to your HSA. Again, be sure to add any prior year contributions before filing Form 8889. Using this and your W2, you can calculate the employee contributions to your HSA.

Employee Contributions equal contributions on Form 5498-SA minus those on your W2 Box 12 “W”

What this is saying is, “Total HSA contributions – Employer Contributions = Employee Contributions.” Using these two documents, you can back out and determine your contribution amount.

Alternatively, you may be able to access your HSA custodian’s website to see a breakdown of employee vs employer contributions. But it is always best to confirm with the official documentation in case you need to correct anything.

Impact on Form 8889

Now that we know the difference between employee and employer contributions, you need to handle them correctly on IRS tax form 8889 for Health Savings Accounts. You will report your (post-tax) employee contributions on Line 2, and employer (including cafeteria plan) contributions on Line 9.

Note: if you need help accounting for your HSA contributions, please consider my service EasyForm8889.com to complete Form 8889. It asks simple questions in a straightforward way and will generate your HSA tax form in 10 minutes. It is fast and painless, no matter how complicated your HSA situation.