This question was submitted by an HSA Edge reader. Feel free to send in your question today to evan@hsaedge.com.

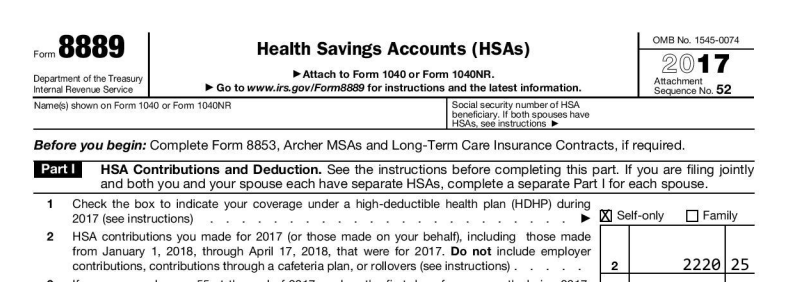

My current insurance plan is HSA compatible, which I’ve had since January 1st, 2017. On January 1st of 2018 I am changing to a plan that is not HSA compatible. If I contribute this year and not in 2018, will I be penalized on the money contributed in 2017?

People are often concerned about over contributing to their HSA, likely on account of how easy it is to use (and abuse) the Last Month Rule. Its use allows you contribute more to your HSA in the current year, but binds you to the Testing Period, which requires you to maintain additional coverage into the following year. If you fail to do that, taxes and penalties await you.

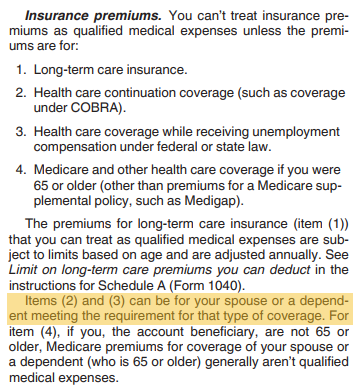

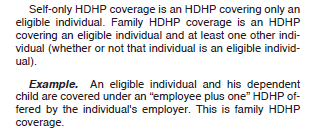

The point to remember is you can never be penalized for contributing for months where you actually had coverage (see: Not Using the Last Month Rule when Coverage Changes). So in your case, you had coverage for 12 months in 2017 and are allowed to contribute for 12 months in 2017, which is 100% of the HSA contribution limit. In fact, the Last Month Rule doesn’t apply to you since you had coverage all year – you can’t possibly contribute more. But consider the scenario where you had coverage for only 7 months, say from June – December. You would have “earned” those 7 months and could contribute 7/12 of the contribution limit for the year without risk. However, you would also have the option to use the Last Month Rule and contribute the full year contribution limit, effectively contributing for those 5 months you weren’t covered.

This then puts you at risk since you are using the Last Month Rule to contribute more than you otherwise could have. This is allowed, and often a good idea, but if you fail to continue HSA coverage for the following 12 months (through next December), you will fail the Testing Period. This is where extra taxes and penalties come to bite you. In the prior example, those 5 months you didn’t have coverage would be added back to income (so they are taxed), plus a 10% penalty would be applied.

So using the Last Month Rule has a risk, but know that you can always play it safe and only contribute for the actual months you had coverage. If you know you are losing HSA coverage due to insurance/job/Medicare changes, do not use the Last Month Rule.

Note: if you need help with Last Month Rule calculations, or just need to file your Form 8889, please consider using my service EasyForm8889.com. It asks simple questions in a straightforward way and will generate your completed HSA tax forms in 10 minutes. It is fast and painless, no matter how complicated your HSA situation.