Need help keeping track of your HSA throughout the year? Sign up for the HSA Edge newsletter for infrequent but important information regarding deadlines, limits, and steps you can take to get the most of your Health Savings Account.

Penalty on Non Qualified Withdrawals

Health Savings Accounts are generally required to be spent on qualified medical expenses. Contributions you make have great tax advantages based on the assumption that you will use them for their intended purpose, which is medical care for you and your family. Deviating from properly spending the funds can result in taxes due, as well as a 20% penalty. You can read about options for cashing out your HSA, but there aren’t many ways around getting money out without paying that 20% penalty.

That all changes once you reach the age of 65 years old. Besides being eligible for Medicare (which can affect your HSA eligibility), at age 65 your HSA no longer penalizes you for taking funds out of it. This is a huge advantage is your HSA becomes much more flexible and can be spent on anything, not just qualified medical expenses. This is one reason why HSA’s are a great retirement vehicle. While always avoiding tax on medical purchases, the HSA basically converts into a 401(k) or IRA (invest pre-tax, pay taxes later) at the time you turn 65. Conveniently, this is right around retirement time, so your HSA has served you like an IRA with a great medical option on it. As you will see, some distributions after age 65 will still incur a tax, but all distributions will avoid the 20% penalty. Per IRS Form 969:

Additional tax. There is an additional 20% tax on the part of your distributions not used for qualified medical expenses. However, there is no additional tax on distributions made after the date you are disabled, reach age 65, or die.

Using HSA funds for Qualified Medical Expenses at 65

Even after reaching 65, your Health Savings Account is still the best way to pay for medical, dental, or vision care for you and your family. This is because the triple-tax advantage still exists for the HSA: pre tax funds, no tax on earnings, and no tax for medical expenses. That means that any medical care you receive after age 65 is still paid for tax free using your HSA. You should remember this and guard those HSA dollars to avoid paying the tax man more than is needed.

For this reason alone, it may make sense not to use the HSA for things other than qualified medical expenses. As you will see, while you won’t be penalized on those “other” distributions, you will still be taxed, and in turn you forfeit the ability to spend those funds tax-free on medical care. Of course, even after age 65 you can still contribute to an HSA, but at that point you may not be on an HSA eligible plan or may have begun Medicare coverage, which prevents you from contributing. So once the genie is out of the bottle and the HSA funds are gone, it may be tough to get them back in and regain tax free medical spending. The point is to protect those HSA funds since they have the special ability to pay for medical care tax free, and we know that medical spending increases as we get older.

Using HSA funds for anything at 65

Above we mention the way to play this by the book, let’s talk about the fun way to use HSA funds. Once you turn 65, you can withdraw funds from your HSA without penalty. This means you can spend them on retirement, vacations, gifts for your family, fine wine and leather-bound books, or whatever you want. Any time before age 65 doing so would incur a steep 20% penalty on this “incorrect” usage of HSA funds, but in your golden years you can spend freely and enjoy the high life with your HSA. You no longer need to spend your HSA dollars only on qualified medical expenses.

After 65, HSA funds can be spent on things other than qualified medical expenses, but these amounts are added to income, which creates a tax liability.

The only downside is that you will still owe tax on these distributions from your HSA. Any funds you pull from your HSA for non qualified medical expenses will be added to income and taxed, but I argue this makes sense given the tax history of the contribution. You were able to contribute tax-free, your earnings grew tax free, and your funds need to be spent on medical expenses to continue to be tax free. Since you are not spending them on medical expenses, they are added to income like they should have been the year you made the contribution. However, at this point you have enjoyed the advantage of tax free investment growth compounded over many years.

In addition, delaying HSA distributions until this time is beneficial as your tax rate is likely lower in retirement. This results in less of a tax hit than it would have had you been taxed at the time of contribution, likely years ago. For example, at the peak of your career your marginal tax rate may have been 30%. But in retirement, you may be in a 15% tax bracket, so you have effectively arbitraged the tax system and saved yourself significant money.

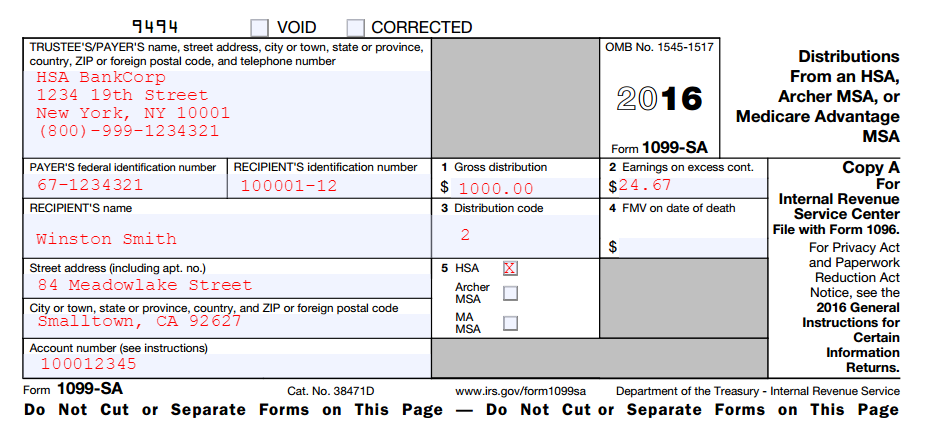

Accounting for Distributions after 65 on Form 8889

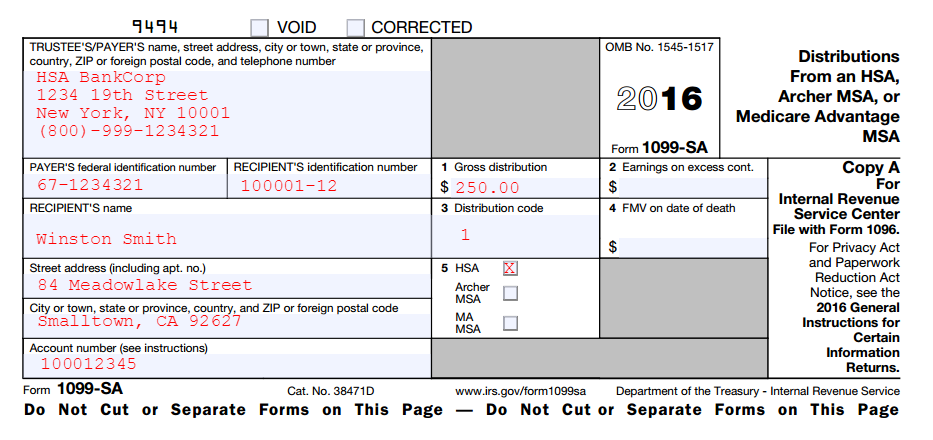

Regardless of what you spend your HSA funds on, you will need to account for it each year with the IRS. This is done with HSA Form 8889 and specifically takes place in Part II – Distributions. We will examine two scenarios and how to account for them.

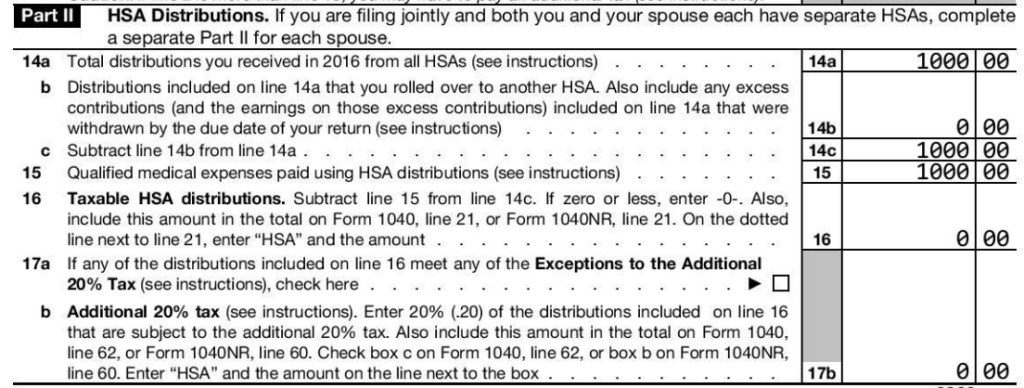

If you are 65 or older and use your HSA to purchase qualified medical expenses, your Form 8889 activity will look the same as if you were not 65. Specifically, you will call out the distribution, and classify it as being spent on qualified medical spending.

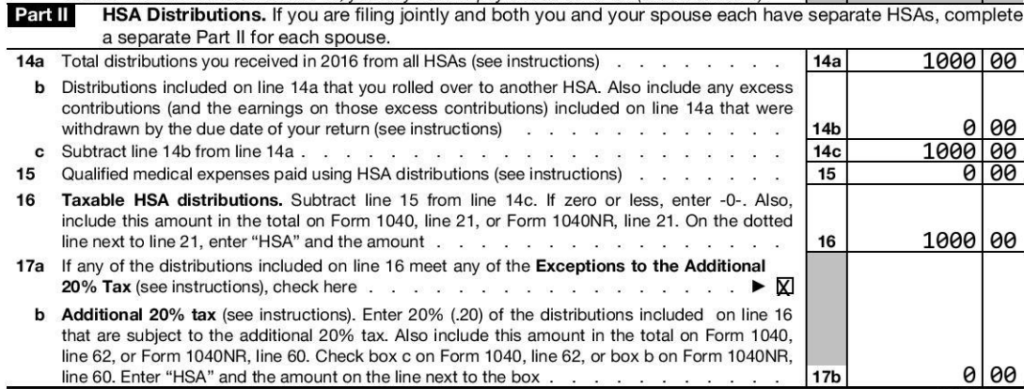

The following was prepared quickly using EasyForm8889.com

If you are 65 or older and you use you distribute from your HSA for something other than medical expenses, the treatment is a bit different. In this case, you call out the distribution amount but enter $0 for the amount spent on qualified medical expenses on Line 15. This will lead to taxable distribution on Line 16. However, there is a checkbox on 17a that you check for distributions over age 65, and line 17b backs these out from the 20% penalty.

This way, the amount is added back to taxable income but the penalty is avoided.

Note: if you need help accounting for your HSA distributions at age 65, please consider using my service EasyForm8889.com to complete Form 8889. It asks simple questions in a straightforward way and will generate your HSA tax forms in 10 minutes. It is fast and painless, no matter how complicated your HSA situation.