This question was sent in by HSA Edge reader Tim. Feel free to email your question to evan@HSAedge.com

I have client whose wife is on Medicare. Client has parent child coverage in effect. Can client contribute full family amount of $7,000 plus $1,000 for being over 55?

Contribution Limit determined by HSA eligibility

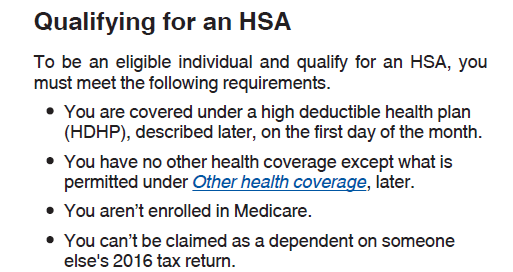

It sounds like you are trying to determine the contribution limit for a family where the wife is not HSA eligible due to Medicare. The contribution limit depends on who is actually covered by the policy, and for what amount of time. Note that Medicare can retroactively affect your HSA coverage. Either way, the IRS test for contribution is called HSA eligibility. It contains 4 rules which are:

If any of the above are violated, the individual is not HSA eligible and they cannot open or contribute to an HSA. It isn’t entirely clear from your email who is covered under the HSA eligible plan and who is not.

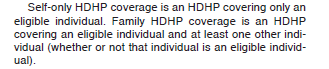

Family coverage includes the eligible individual and at least one other individual – whether they are an eligible individual or not.

Here are the valid scenarios I can think up:

1) Parent and child covered

If your client and the child are covered by the HSA insurance, you are correct in your assertion: family coverage of $7,000 + $1,000 catch up if client is 55+. This assumes the parent is HSA eligible. For example, the wife’s Medicare doesn’t cover the client, which would disqualify based on rule #1 above.

2) Parent, wife and child covered

Same as the above. This would mean your wife is covered by both Medicare and the HSA plan. She is not an eligible individual, and can’t have an HSA, but assuming the client is eligible, he plus the child count as two members which allows the family contribution limit (plus any 55+ catch up contribution).

3) Wife and child covered

If only the wife and child are covered by the HSA insurance, a strange situation develops since the wife is not HSA eligible. Based on the IRS rules in Form 969, at least one eligible individual is required to contribute to the HSA:

This is supported by Form 969, which defines self-only and family coverage. Note the specific language for family coverage and the “Other” individual who is covered:

This leaves the determination based on the covered child, since the wife is not eligible due to Medicare:

- If child is an eligible individual, family contribution applies (no 55+) but must go into eligible individual’s (child’s) HSA.

- If child is not an eligible individual, no contribution limit seems to apply.

Likely, the above test of the child will boil down to point 4 in the eligible individual calculation: is the child is a dependent or not? Basically, “are they old enough to pay taxes?”. The result is odd, in that only the child could open the HSA and contribute the full family contribution limit (no 55+ likely applies). Of course, they would need those funds, or you would need to contribute it for them. Note that this is the scenario discussed in Your Adult Children can Fund their HSA. However, note that the parent’s could not fund the HSA in this scenario.

Covered by HSA, but no contribution limit

The above discussion displays the possible scenario where one’s family can be covered by an eligible HSA plan but they are not allowed a contribution limit. This is generally due to violating the eligible individual definition, but could take the following forms:

- Husband, wife and child are covered. Wife on Medicare, and the Medicare applies to Husband. Child is a dependent.

- Husband and wife have HSA eligible insurance. Wife has an FSA at work, which also covers the spouse, violating the “Other coverage” clause. (Note – in 2018 there was legislative discussion of changing this FSA rule.)

- Family coverage begins on the 2nd of the month. Not eligible to contribute for that month, but can contribute going forward. Note that they have the option to make this up this missed month using the Last Month Rule.

In all of the above examples, HSA coverage exists but due to other factors, the individual has a $0 contribution limit and cannot contribute to the HSA at this time.

Note: If you want help calculating your HSA contribution and filing your taxes, please consider my service EasyForm8889.com. It asks you simple questions and fills out Form 8889 correctly for you in about 10 minutes.