The 100+ person team (kidding?) at the IRS has cranked their magic number machine and released their 2019 HSA limits and definitions. This includes the 2019 HSA Contribution Limits as well as the 2019 HDHP Definitions for Minimum Annual Deductible and Out of Pocket Maximum. These amounts govern 1) how much can be contributed to an HSA and 2) what qualified as an HSA for 2019. Overall, they have done a good job and it will be a good year for HSA savers as well as new people looking to establish an HSA for the first time.

2019 is a strong year for HSA’s in general. Both the self-only and family contribution limits increased, and the HDHP definition has widened, making more people eligible.

2019 HSA Contribution Limits

First, the good news on what you can contribute. If you have an HDHP and have opened a Health Savings Account, below are the contribution limits for self-only and family coverage for 2019:

| 2015 | 2016 | 2017 | 2018 | 2019 | |

| Self-Only HSA Contribution Limit | $3,350 | $3,350 | $3,400 | $3,450 | $3,500 |

| Family HSA Contribution Limit | $6,650 | $6,750 | $6,750 | $6,900* | $7,000 |

| 55+ Additional Contribution Limit | +$1,000 | +$1,000 | +$1,000 | +$1,000 | +$1,000 |

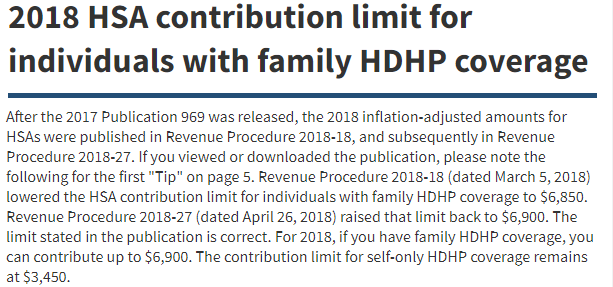

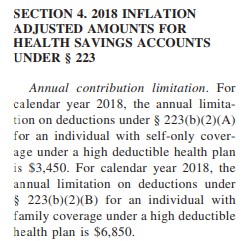

*Note: the IRS reduced and then restated the 2018 Family Contribution limit to $6,900.

2019 is another good year for HSA contribution limit increases. Self-only HSA’s have increased their contribution limit by $50 over 2018, which history shows is about as good as it gets. In addition, the family HSA contribution limit has increased by $100 over 2018. These are solid increases especially compared to the lean years of 2016 and 2017. It seems the IRS is giving the taxpayers a (small) break since these contribution limits determine the deduction your HSA allows. This marks the 2nd year where we have strong increases in both the self-only and family contribution limits. This may be a trend and we hope it continues, since it improves the population’s ability to manage their care in an environment of insane health care costs.

Now, if we could just do something about that catch up contribution! The 55+ catch up contribution has been stuck at an additional $1,000 for what seems like forever…

2019 HDHP Limits

Below are the 2019 HDHP deductible limits as well as out of pocket maximums that determine whether or not your plan is an High Deductible Health Plan, and thus, whether or not you can contribute to a Health Savings Account:

| 2015 | 2016 | 2017 | 2018 | 2019 | |

| Self-Only Min Deductible | $1,300 | $1,300 | $1,300 | $1,350 | $1,350 |

| Self-Only OOP Max | $6,450 | $6,550 | $6,550 | $6,650 | $6,750 |

| Family Min Deductible | $2,600 | $2,600 | $2,600 | $2,700 | $2,700 |

| Family OOP max | $12,900 | $13,100 | $13,100 | $13,300 | $13,500 |

Overall, HSA coverage is easier to obtain after the IRS changes in 2019. This is true for two reasons. First, the IRS has kept constant the minimum annual deductible for both self-only and family coverage. This amount is the lowest deductible your plan can offer and still be HSA eligible. In 2019, a self-only plan must have a deductible at or above $1,350, while a family plan deductible must be at or above $2,700. As a result, some plans with low deductibles are ineligible to contribute to an HSA since their annual deductible is too low. In prior years, the IRS has increased the minimum annual deductible that defined HDHP (and HSA ) plans. By keeping it constant, it allows more plans to participate. This is especially true in an environment of rising health care costs.

Second, we see large increases in the out-of-pocket maximum. This is the highest amount your plan can make you pay for care in a year. The self-only out-of-pocket max has increased by $100 to $6,750, while the family out-of-pocket max has increased $200 to $13,500. Anything more and the plan is not HSA eligible. This results in more plans with very high deductibles being included in the HDHP definition. It is an open question as to why there needs to be an OOP max at all in the HDHP definition, but either way, an increase in this metric in an environment of rising costs (not just rising premium, but decreasing coverage) is positive. This site maintains that the more HSA’s opened, the better.

2019 HSA Wish list / Forecast / Political Outlook

With Christmas around the corner, here is our 2019 wish list for HSA’s:

- Remove retroactive Medicare penalty

- Higher contribution limits

- More people eligible for HSA’s

Of course, what we really want to see is the minimum annual deductible decrease or disappear. That relates to #3 above but has never really happened – the best case, like this year, is it remains constant year over year. Decreasing this would allow people with more diverse insurance plans take advantage of HSA’s as well.

Perhaps that occurs sometime in the future, but short-term that is unlikely with a split Congress going into 2019. Bills improving HSA’s were introduced during the first 2 years of Trump’s term, during which he held a majority in both houses, but no one could agree on anything and no new laws were passed. With the mid-term elections completing in November 2018, the outlook for HSA’s has decreased, as it is unlikely anything improving (or worsening) HSA’s will be passed in the forthcoming gridlock.

Note: When you file your 2019 taxes and need to complete Form 8889 for your HSA, please consider my service EasyForm8889.com. It asks you simple questions and fills out Form 8889 correctly for you in about 10 minutes.