Overview

You have HSA eligible coverage and opened a Health Savings Account, diligently making contributions throughout the year. You now have a nice nest egg to protect yourself from routine care, medical surprises, and emergencies. However, on whom you can spend your HSA funds can be confusing. We have previously discussed who can use your HSA funds but the issue of step children, or children of separated parents, is a special case. Sometimes, taxes and step children can be a tricky situation. In this article, we will discuss that step children can be the beneficiaries of your HSA funds.

The IRS Chimes In

The IRS generally lists 4 categories of people on whom you can spend your HSA contributions:

- You

- Your spouse

- Your dependents

- Anyone you could claim as a dependent

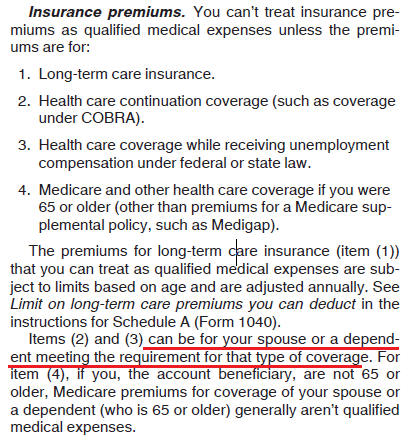

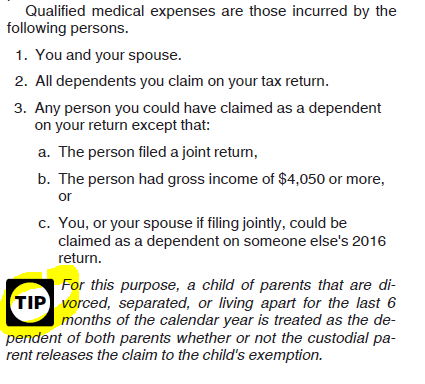

You will notice that step children are not mentioned in the common recipients here. But if you dig a little deeper into the IRS materials you will find a surprising answer. In a rare moment of foresight, the IRS directly addresses the case of step children issue in a follow up discussion of this rule. This appears in Form 969:

The IRS states that if the parents have been divorced or separated or living apart for the last 6 months of the calendar year, the child is considered a dependent for both parents. That child then falls into point 3 in the above list of HSA eligible expenses, so you can spend your HSA on them.

A child of parents that are divorced, separated, or living apart for the past 6 months of the calendar year is treated as the dependent of both parents.

However, it isn’t clear if this “6 months” applies only to the 3rd case (living apart) or all three cases (divorced and separated). All hail the Oxford comma! Why the IRS includes this confusing 6 months of calendar year test is beyond me, perhaps it is used as some basis to confirm the parents are actually living apart for good. So what if the parents separated in January-June versus later in the year, say September? Does the 6 months of a calendar year (July-December) have to be satisfied before the child is treated as a dependent? That just seems weird to me.

HSA’s and Step Children

My interpretation (which has not been confirmed) is that the 6 months applies only to parents living apart. Thus, if you are divorced or separated, your HSA funds can be applied to your step children, regardless of who has custody of the children. Also note that this applies to your spouse’s children i.e. your stepchildren.

Let’s assume a situation where a mother and father with 1 child separate and remarry; here are some examples of who can spend HSA funds:

- Mother spends HSA on child

- Stepfather spends HSA on child (technically their stepchild)

- Father spends HSA on child

- Stepmother spends HSA on child (technically their stepchild)

In addition, if the mother and father remarry and their respective spouse has children, they now have stepchildren of their own and can spend their HSA on them:

- Mother spends HSA on their stepchild

- Father spends HSA on their stepchild

In sum, the HSA is flexible enough to allow for spending funds on stepchildren, if you can make your way past the IRS wording.

Note: If you need help preparing your HSA tax form 8889, please consider my service EasyForm8889.com. It asks you simple questions and fills out Form 8889 correctly for you in about 10 minutes.