This question was submitted by HSA Edge reader Felicia. Feel free to submit your question today to evan@hsaedge.com.

I would like to withdraw money from my HSA as a non qualified withdrawal. How do I do this?

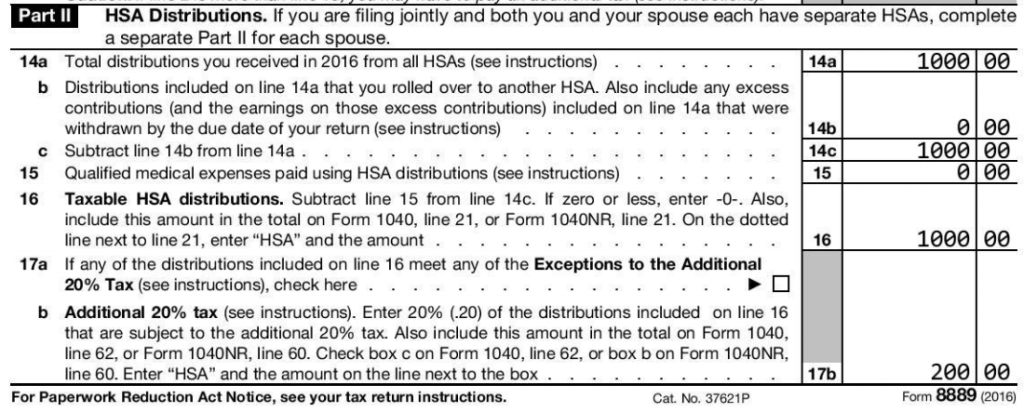

Doing a non qualified withdrawal from an HSA is dangerously simple – all you have to do is take the money out. There are no forms during the distribution that declare whether it is qualified or not. Instead, this will be settled at tax time when you file Form 8889. It will ask how much money was withdrawn from your HSA, and how much of that was used to pay for qualified medical expenses. The difference is taxed and penalized as a taxable (non qualified) HSA distribution.

Here is an example of a non qualified withdrawal for 2016 created by EasyForm8889.com:

In your case as in the above example, the amount withdrawn and the amount spent on qualified medical expenses do not equal. Thus, those are non qualified distributions and that amount is added to income and penalized. However, paying taxes and penalty may be worth it to get access to the funds.

There are some exceptions to paying the penalty – namely reaching age 65, becoming disabled, or dying – but those don’t often apply.

Of course, I would advise that you try to get this money out penalty free, so recommend my article Can You Cash Out An HSA. There are a few methods you can use to get funds out, but most involve incurring some sort of medical expense to disburse the funds. However, thinking creatively can help bridge this gap. For example, are there things you are spending money on that are actually qualified medical expenses? Or, are there any qualified medical expenses in your near future (e.g. glasses, doctor’s visits, procedures) that you can pull forward to at least get access to the HSA funds?

————————————

Note: If you need to account for non-qualified withdrawals on Form 8889, please consider my service EasyForm8889.com. It asks you simple questions and fills out Form 8889 correctly for you in about 10 minutes.