A common question readers have is how employer contributions to a Health Savings Account work and how they affect their HSA contribution limit for a year. HSA’s are very flexible in that basically anyone can contribute to your HSA (see: Who Can Contribute to a Health Savings Account), including yourself, your family, others on your behalf, and your employer. However, some differences exists for those contributions made by your employer in terms of taxation, reporting, and contribution limit.

Do employer contributions to HSA count towards maximum?

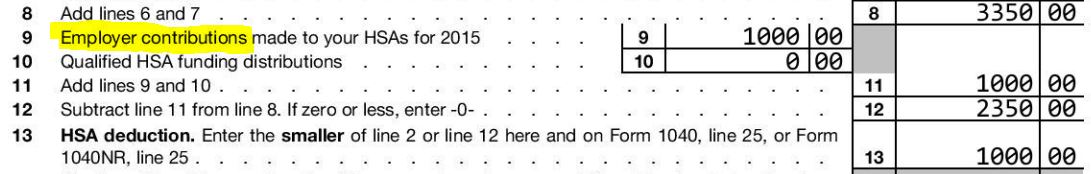

The short answer is yes, employer contributions count towards your HSA maximum contribution limit for the year. Looking at HSA tax Form 8889 shows you how this occurs:

The above Form 8889 was prepared quickly using EasyForm8889.com.

HSA Employer Contributions are entered on Line 9 of IRS Form 8889, so whatever your employer contributes to your HSA goes there. Line 12 is where the employer contribution actually affects your HSA contribution limit, since it subtracts the employer contribution from Line 8 which is a “running total” of your contribution limit up until that point. The result is compared to Line 2, your actual HSA contribution, and the smaller is reported on Line 13 which carries over as your deduction to Form 1040. So the net effect of this comparison is that employer contributions reduce your contribution limit from Line 3.

Are employer HSA contributions taxable?

For the account holder, if made directly to your HSA, Employer Contributions are not taxable to you. As you can see above, the amount flows into Form 8889 on Line 9 and then onto Form 1040 Line 25, which is in fact a deduction. So the employer contributions are reducing the possible tax deduction, but of course, this is free money. You can’t receive an employer contribution and then take a deduction for it. How the employer contributes matters, though. If your employer were to simply write a check and say “here is your HSA contribution”, this would be treated as a “bonus” or regular income and taxed. It would be wise to coordinate with the employer as it would be to both of your benefits.

For employers managing a corporation, HSA contributions are a deductible expense so are treated preferentially and reduce your tax liability. For S-Corps and Partnerships, the contribution is treated as a distribution which is claimed by the recipient, but not the business.

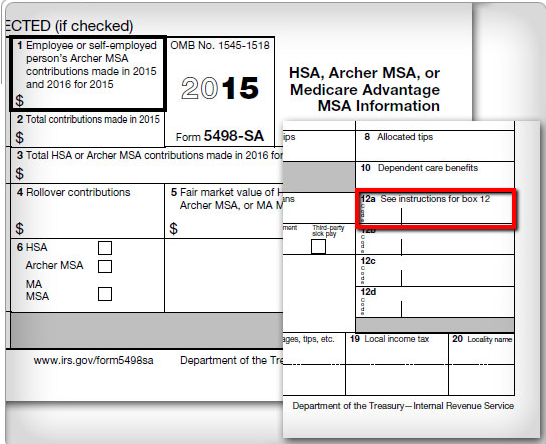

HSA Employer contributions found on W2

HSA contributions from your employer are shown on Box 12 of your W2 with code “W”. They will take one of the available Box 12 spaces, mark a “W” to indicate HSA, and enter the amount in the box to the right. If only your employer contributed to your HSA, this is easy and you are done.

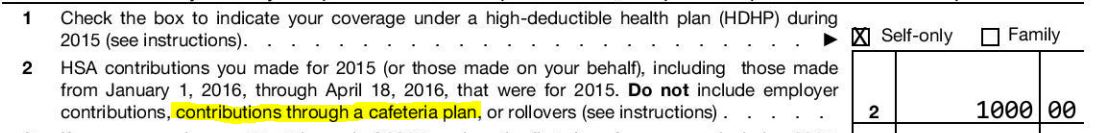

However, one confusing aspect of this is that your personal contributions made to your HSA may show here if they were withheld from your paycheck. These are called “cafeteria plan” contributions and should in fact be put on Form 8889 on Line 9, not Line 2. This is a common mistake, but looking at Form 8889 Line 2 you can see that these cafeteria plan contributions are excluded and instead go on Line 9 (employer contributions):

The above Form 8889 was prepared quickly using EasyForm8889.com.

HSA contributions: employee vs. employer

The main difference between employee and employer contributions is who is paying for them. Of course, free money is free money, so if you can get employer contributions, do it! Another difference is how they get into your Health Savings Account: employer contributions should be directly deposited, whereas you will contribute your HSA contributions manually. Note the exception here is if you make cafeteria plan contributions, which are withheld from your paycheck (see above). Additionally, employer contributions go on Line 9 of IRS tax form 8889, whereas personal contributions go on Line 2.

On the other hand, there are many similarities between employee and employer contributions. Both types of contribution count toward your HSA maximum contribution limit. This occurs in different sections of Form 8889, but eventually they make there way to Line 13 which is your HSA deduction that flows to Form 1040. Both types of contribution go into your Health Savings Account and are yours forever, and you may spend them on whatever qualified medical expense you want. Your employer will never see how they were spent and cannot claw back those contributions.

HSA employer contribution limits for 2016

The maximum amount your employer can contribute to your HSA is calculated in the same manner as your personal contribution limit. For 2016, the HSA maximum contribution limit is $3,350 / $6,750 for single / family coverage. In addition there is a $1,000 catch up limit applied to those over 55 years old. So between your personal and employer contributions, you cannot exceed this limit. If you are on single coverage and your employer contributes $3,350 to your HSA, you can make $0 in personal contributions for the year without over contributing. However, if you are 56 years old with single coverage and your employer contributes $3,350, you could make a personal $1,000 contribution for a total of $4,350 as part of the 55+ additional catch up contribution.