Update: Unhappy with my previous record keeping attempts, I created an online software called TrackHSA, a service to help manage your Health Savings Account. Track purchases, upload receipts, and record reimbursements for all HSA purchases to help you minimize your taxes and satisfy the IRS.

You can learn more about TrackHSA here.

Overview

There are a number of reasons to setup a simple, organized system for maintaining your health savings account records. Due to its tax advantaged nature, your HSA has implications for your income taxes, so it is important to keep proper records. If – God forbid – you are ever audited by the IRS, you will already have all relevant information at hand. Perhaps more importantly, this system allows you to track your unreimbursed qualified medical expenses. This ensures you never pay too much in tax while knowing how much you can pull from your HSA, tax-free, in the event of an emergency.

The major complication with an HSA is the length of time between contribution, spending and reimbursement. Depending on your age, you could have 40+ years until you need to provide proof of spending. This especially applies if you are young and saving for the long haul. For example, if I pay for QME out of pocket at age 25, I may not need to reimburse myself – depending on my financial condition – for that expense until I am 55. This is part of the strategy of using your HSA as an ATM.

Luckily, there are simple cloud-based solutions that can help retain your records. I have written TrackHSA just for this application, but you could also use Dropbox or Google Drive to backup any and all information on offsite, secure servers. In theory, this is a fail safe and secure way of backing up your HSA receipts. I also back up this same information on my external hard drive but this is prone to fail.

My HSA Record Keeping System

Keeping appropriate records for your Health Savings Account is easy with dedicated software. Given all of the manual storage (and risk) you can read about in my old system below, I needed an online software that tracked and stored all of my HSA transactions and receipts. I didn’t want to run the risk of it getting lost / deleted, and I needed it to be secure and able to do the work for me. So I set out to build TrackHSA, and that is what I did.

TrackHSA functions as a both a listing and calculator for your HSA activity. While your HSA bank account can tell you the amounts that go in and out of the account, it does not characterize those transactions in relation to an HSA. For example, say you withdrew $200 from your HSA last month. Without context, you will not know if that $200 was for a purchase (no receipt), a prior reimbursement (no transaction context), or an unqualified withdrawal (no notes). TrackHSA fixes this by providing context to your HSA from the transaction perspective, putting the focus on uses of your HSA for qualified medical expenses. By tracking the actual HSA transaction, you can not only upload the receipt to justify the expense to the IRS should they audit you, you can track whether or not that purchase has been reimbursed. Delaying reimbursement is a great strategy to let your tax advantaged HSA account grow, and TrackHSA helps you justify the reimbursement when you do so down the line.

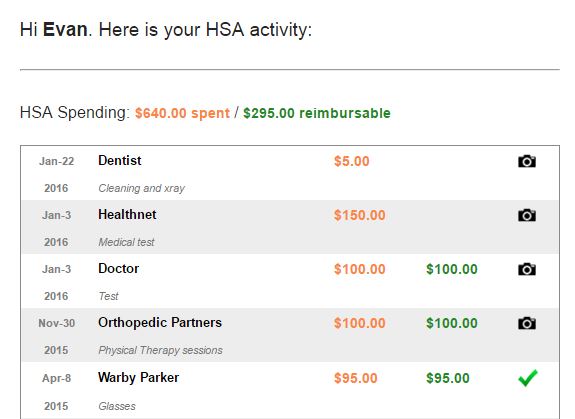

How I use TrackHSA.com

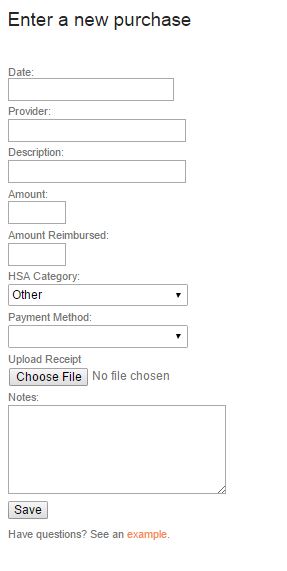

Whenever I make a qualified medical expense, I log it in TrackHSA. When you login you can see a summary of your HSA activity. On the right, you can enter a new purchase and categorize it. You can record detailed information about the purchase, including the provider, description, amount paid, amount reimbursed (important!), HSA category, payment method, and free form notes. This information comes in useful when you need to reimburse prior purchases or determine if a transaction was HSA eligible.

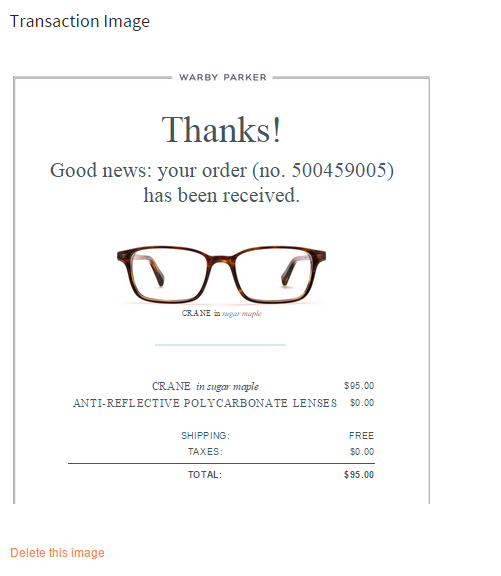

Only 3 fields are required so you can quickly create purchases and come back and add more information later. When creating the transaction, you can optionally upload an image of the receipt. This is a best practice because it confirms that the transaction occurred, especially in the eyes of the IRS. Uploading is simple and the image is stored securely to your account, and no one else has visibility to it.

Once uploaded, the camera icon on the summary screen becomes a green checkbox indicating that the transaction has a receipt. When you click on that transaction for more detail, the image is displayed so you can reference it. You can also download it in its original form for your records later on.

Overall, this is a simple system for managing your HSA spending and receipts. I will be adding more features to it in the future, but it can serve as a tool for helping you maintain your HSA records and audit proof yourself in case the IRS comes knocking. Moreover, it will put you on top of your finances and help you maximize your Health Savings Account.

Note: the following section was the initial meat of this post and I am keeping it for history’s sake, in case you want to setup your own HSA record keeping on your computer.

My Old System circa 2013 (pre TrackHSA)

I update my records 4 times a year, at the end of each quarter. I can usually accomplish this record keeping in less than 1 hour per quarter. Sometimes I cheat and add QME receipts as they come in so I don’t lose them, but would like to move this to a once a quarter filing system.

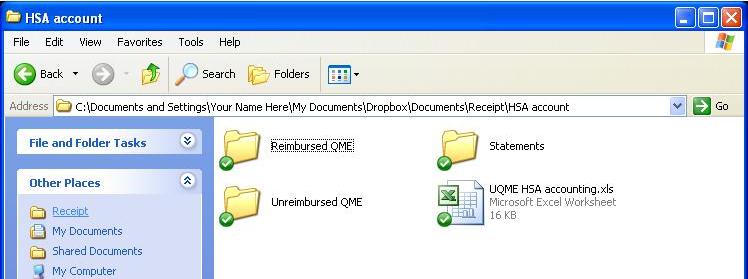

In my Dropbox folder, I have a folder called HSA with the following subfolders:

- Statements

- Unreimbursed QME

- Reimbursed QME

Here is what this folder looks like. The green check marks mean it is synced to Dropbox and up to date.

The function and characteristics of each folder are such:

- Statements– I download my quarterly statement from HSA Bank, my HSA provider. This details all account contributions and withdrawals that occurred in a given quarter. It is a good reference and could help reconcile your account as needed.

I label my statements in the format [HSA Statement 1 2012], where the first number denotes the quarter.

- Unreimbursed QME– I keep copies of all invoices or receipts for QME that I have incurred throughout the year. In this folder are items that are unreimbursed. In other words, I paid for medical care out of pocket instead of using my HSA. Doing so allows my HSA to grow and compound. I save each receipt by either scanning (old school) the invoice or taking a clean picture (new school) using my camera. I name the files in the format of [Date-Company-Amount] (e.g. 2012-12 Kaiser $45) so I can sort through them quickly.

A nice benefit of this system is that the sum of all invoices in the Unreimbursed QME folder equals the amount I can pull from my HSA tax-free.

- Reimbursed QME – This folder contains copies of invoices or receipts that I have paid for with my HSA. There are two ways that I can pay using my HSA. The simplest way is to buy using my HSA Bank debit card. This is straightforward and doesn’t require any further accounting; the receipt begins and ends in Reimbursed QME. However, that money is now gone from my HSA.

Alternatively, I can purchase the medical care out of pocket using cash, credit card, or check. Since the purchase was considered a Qualified Medical Expense, I can reimburse myself for that purchase from my HSA (tax free dollars). This is effectively the same as paying for the QME with my HSA. However, I may choose to delay that reimbursement so my HSA funds can grow.

Using this method, once the reimbursement ($ transfer from HSA to my personal checking account) occurs, I simply move the invoice from the Unreimbursed QME folder to the Reimbursed QME folder. This finalizes that QME, and my new (lower) amount of UQME is reflected by the contents of that folder..

- Excel Spreadsheet – I created a simple Excel spreadsheet that summarizes all out of pocket spending for qualified medical expenses. I update this sheet when I 1) incur new UQME cost (add) or 2) reimburse myself for UQME (reduce). This sheet conveniently shows a total for UQME, or the amount you can withdraw from your HSA, tax free. That total should balance with your receipts in your UQME folder. You can download a free copy here.

In the end, do whatever works for you. Just make sure you have all needed information, especially the Unreimbursed QME portion. This is money you are entitled to withdraw, tax free. If you aren’t tracking it, who is?

There are only a few folders and a few actions that I perform once a quarter. In return, I have piece of mind of knowing the value of my accounts as well as how much I can pull from the HSA in case of emergency. I am also covered in the event of an audit.

Let me know if you need any help getting your system setup.

Tweet